A New Way to Start Investing

Getting started with investing used to mean big money, complicated platforms, and confusing jargon. Not anymore.

Micro-investing apps have changed the rules — now anyone in the United States can start building wealth with just a few dollars and a smartphone.

This guide breaks down the best micro-investing apps for beginners in the US, showing you how to start small, stay consistent, and make your money work for you.

What Is Micro-Investing and How Does It Work?

Micro-investing lets you invest tiny amounts of money into the stock market or ETFs (Exchange-Traded Funds). Instead of buying a full share, you buy a fractional share — meaning you can own part of Apple or Amazon with as little as $1.

Most micro-investing apps automatically invest your spare change. For example, if you spend $4.60 on coffee, the app rounds up to $5 and invests the remaining $0.40. Over time, these small amounts grow into real money through compound interest.

This is what makes micro-investing ideal for beginners: low barrier, low risk, and high learning value.

The Best Micro-Investing Apps in the US (2025 Edition)

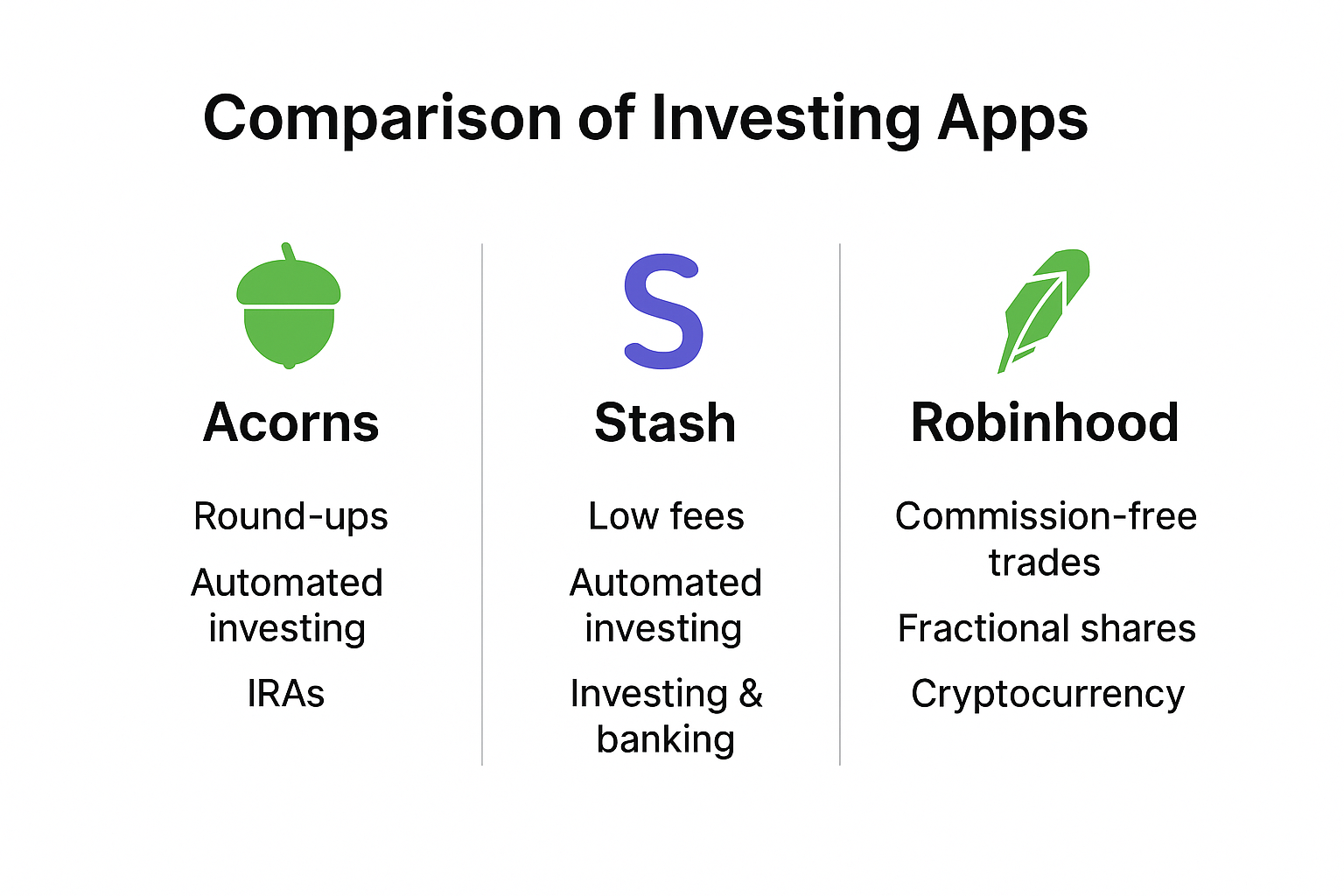

1. Acorns — Invest Your Spare Change

Acorns rounds up your everyday purchases and invests the difference in diversified ETF portfolios.

- Best for: Complete beginners

- Minimum investment: $5

- Bonus: Educational content and automatic rebalancing

2. Stash — Learn While You Invest

Stash blends investing with personal finance education. You can start with $1 and choose fractional shares from top companies.

- Best for: Beginners who want control and learning tools

- Unique feature: Stock-Back® Card — earn stock instead of cash back

3. Robinhood — Simple Investing with No Fees

Known for commission-free trades, Robinhood is perfect for those who want to buy fractional shares directly.

- Best for: Users ready to explore beyond automation

- Downside: Less beginner guidance

4. SoFi Invest — Great for Goal-Oriented Investors

SoFi offers both automated investing and active trading. You can also access free financial planners.

- Best for: Beginners with long-term financial goals

5. Public.com — Social Investing for the Curious

Public turns investing into a social experience. You can follow other investors, read their insights, and invest in themes like “clean energy” or “tech innovators.”

- Best for: Those who enjoy community learning

How to Start Micro-Investing (Step-by-Step)

- Choose your app: Start with Acorns or Stash — both are beginner-friendly.

- Set a goal: For example, “Invest $25 a month for 12 months.”

- Link your debit card: This enables automatic round-ups and recurring deposits.

- Diversify: Choose a portfolio mix of ETFs, not just single stocks.

- Stay consistent: The secret is time and patience, not timing the market.

Tip: Don’t withdraw early. Let compound interest work for you — it’s the quiet engine behind long-term growth.

Common Mistakes to Avoid

- Checking daily performance: Focus on years, not days.

- Chasing hype stocks: Stick to diversified funds and proven assets.

- Skipping auto-deposits: Automation beats willpower.

- Ignoring fees: Always review the app’s management costs.

Avoiding these small mistakes makes the difference between “trying investing” and becoming an investor.

Final Thoughts — Start Small, Think Big

You don’t need thousands to start investing. You need consistency and time.

Micro-investing apps are your entry door — a low-pressure way to learn, build habits, and grow wealth one dollar at a time.

📈 Ready to begin? Download one of the top apps above and grab our Free Beginner’s Checklist to start your first investment today.

Deja una respuesta